Yo, Anthropic…what up?

Enron wiped out $74 billion. Anthropic may do five times that — not from fraud, but from narrative collapse.

Anthropic’s valuation tells one story.

The capital tells another.

CNBC reported an implied valuation of roughly $350 billion in November, yet publicly disclosed investments from Amazon and Google total about $11 billion, much of it tied to cloud-usage commitments rather than clean equity.

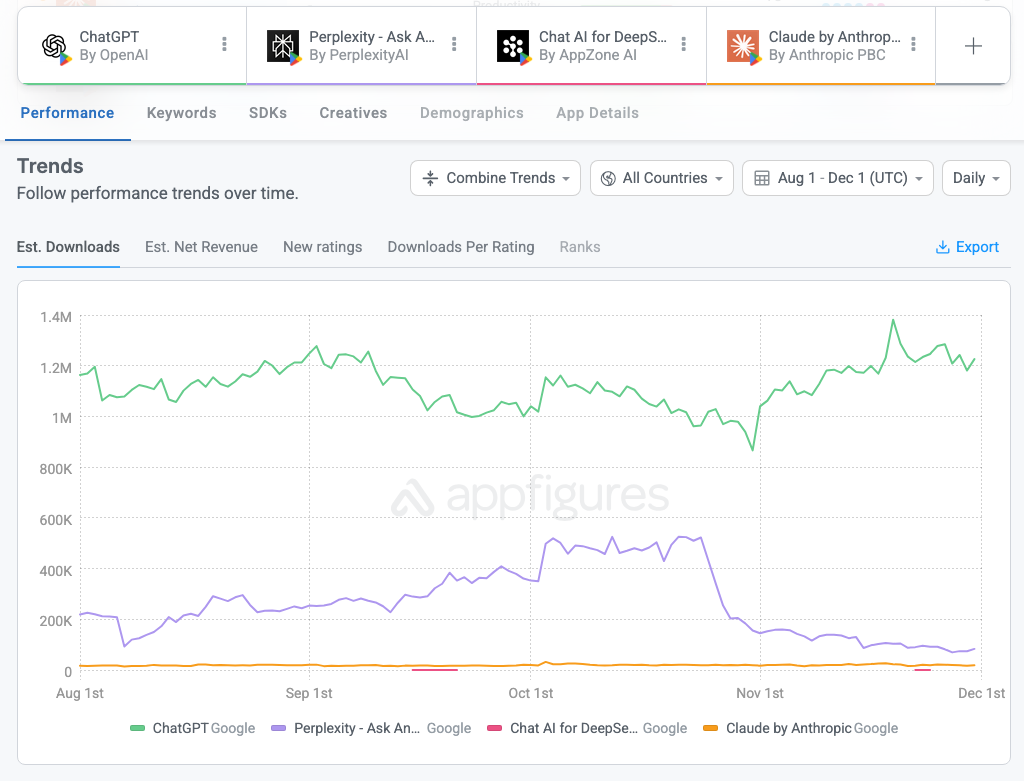

That leaves more than 95 percent of the valuation unsupported by paid-in capital, at a moment when Claude usage has been flat for at least six months. That gap isn’t a rounding error — it’s the entire risk.

Claude usage has been flat since last spring. That’s nearly a full year of zero growth. We have the data from multiple sources. See below.

And yet Anthropic kept raising money at ever-higher valuations — now approaching $350 billion — all based on an assumption of continued exponential growth. That’s the lie. Not criminal. But consequential.

The entire infrastructure play — tens of billions in compute and capacity contracts — was justified by rising utilization. But there is no rising utilization. There is no surge. There is no breakout. The adoption curve went flat... and stayed there.

In public, they sold momentum. In private, they watched the needle stop moving.

Now they’ve built a company with:

- No hard assets

- No consumer moat

- No standalone defensible IP

- A brittle cost structure

- And a valuation entirely based on “more”

But more never came.

When a company like that hits reality, the repricing isn’t gradual. It snaps. Just like Enron. Just like Pets.com. Just like WeWork. Just like Webvan. Just like every over-leveraged story stock that confuses narrative with value.

So here we are.

Anthropic must have known that Claude had gone flat. But they said nothing in their 10-Qs.

They don’t need better PR. They need a lifeline. And if they want a story that can survive the next quarter, it better be one that actually holds up under scrutiny. Because the music just stopped.

– Published December 17, 2025