Wall Street heeds stark warnings from OpenAI, Google and Microsoft

For weeks now, the biggest names in AI have been signaling turbulence — in their own words, in their own guidance, and in their own internal communications.

And yet, despite these warnings from the companies building AI, Wall Street continued to price perfection. Until Friday. Then the reckoning began.

Here is what AI’s leaders were saying:

OpenAI: “Investors are overexcited… yes, we’re in a bubble.” — Sam Altman

In a recent interview, Sam Altman was asked directly whether we’re in an AI bubble. His answer was unambiguous:

“Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes.”

(Verge interview)

He went further, adding:

“When bubbles happen, smart people get overexcited about a kernel of truth.”

And then came the leaked memo a week ago Saturday.

According to independent reporting, Altman warned employees that Gemini 3 could create “temporary economic headwinds” and that:

“I expect the vibes out there to be rough for a bit.”

That memo also described a “code red” refocus on stabilizing ChatGPT — delaying ads, agents and new feature rollouts.

When a CEO calls his own industry a bubble, warns of “rough vibes,” and declares a code red, investors normally pay attention.

Wall Street didn’t.

Sam Altman fiddles while OpenAI burns cash

NVIDIA: Jensen Huang signals slowing enterprise demand

NVIDIA, the backbone of the AI hardware boom, has begun softening its tone.

Across earnings calls and analyst briefings, Jensen Huang has acknowledged “lumpy demand” and slower enterprise deployment cycles — a diplomatic way of saying that customers are not scaling GPU consumption in a straight line.

When the company selling the picks and shovels starts talking about uneven demand, that is not a bullish signal.

Wall Street didn’t blink.

Google: “We need to right-size expectations.” — Sundar Pichai

Sundar Pichai has repeatedly emphasized the need for “responsible scaling” and the importance of “right-sizing expectations” around AI capability and rollout speed.

That is CEO-speak for: We cannot deliver what the hype cycle is currently pricing in.

Yet the market continues to behave as if limitless growth is guaranteed.

Microsoft: “We need to be clear-eyed about the next phase.” — Satya Nadella

Satya Nadella has echoed the same caution:

- rising cost structures

- heavy infrastructure requirements

- uncertain regulatory horizons

- slower-than-expected enterprise adoption

His phrase — “clear-eyed about the next phase” — is the same kind of language CEOs use when telling analysts that the runway ahead is not as smooth as the valuation suggests.

And still the market shrugs.

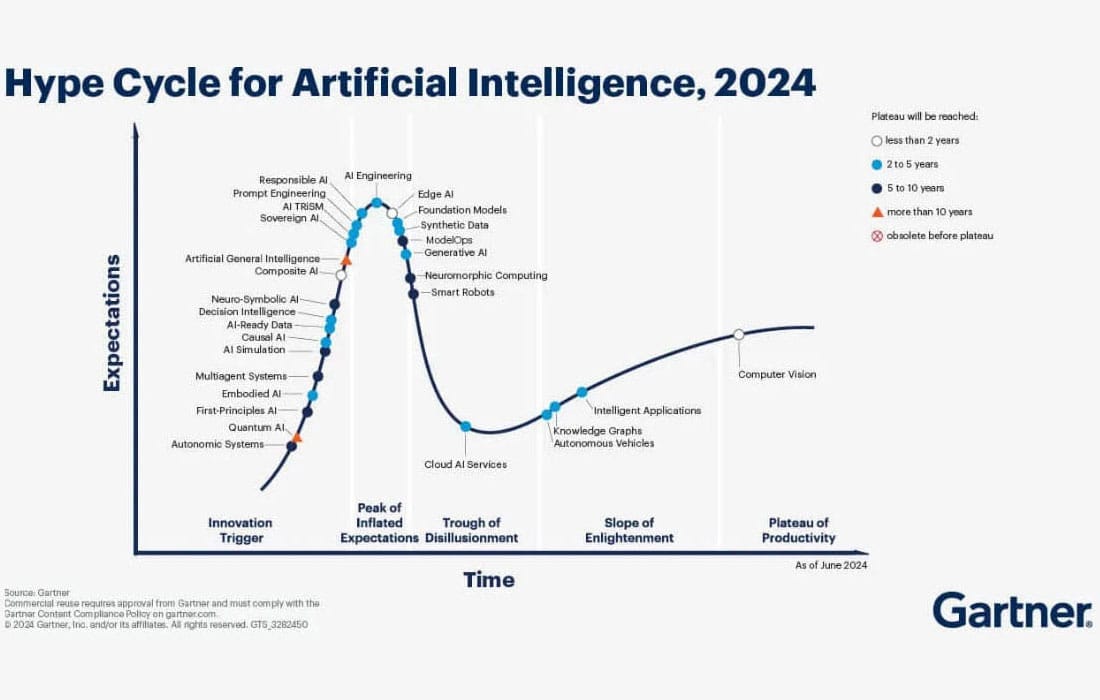

Then there’s Gartner — the global authority on hype cycles

Gartner placed Generative AI at the Peak of Inflated Expectations in its 2023 Emerging Technologies Hype Cycle.

And in the 2025 AI Hype Cycle, Gartner identified AI agents, AI-ready data, multimodal AI, and AI TRiSM as the fastest-advancing technologies — explicitly noting they were positioned at the Peak of Inflated Expectations.

When Gartner says we are at the peak, history shows what usually comes next.

And then there’s me. I called this last week.

I’m not the CEO of OpenAI.

I’m not running NVIDIA, Google or Microsoft.

But I track patterns, I follow data, and I act when signals converge.

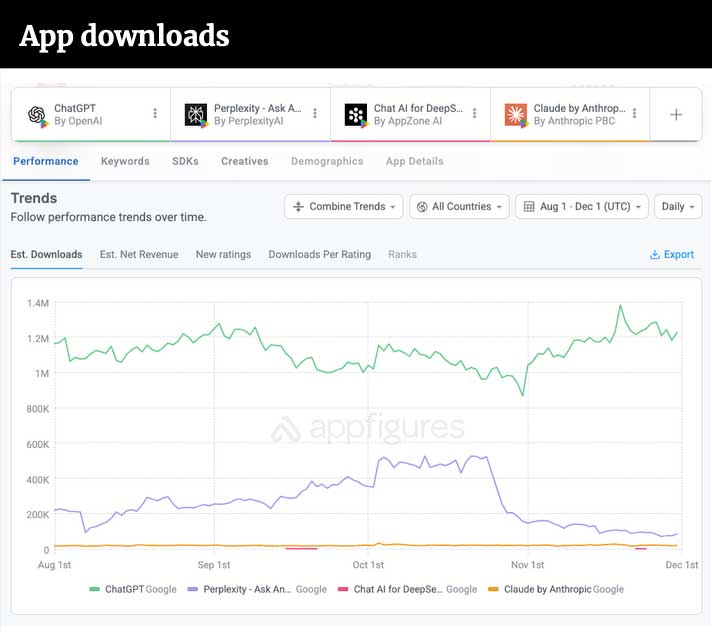

Before Altman said “bubble,” I published two analyses showing that AI adoption had already flatlined from August to October:

The charts were unmistakable.

While valuations soared, usage growth had stopped.

I didn’t call the bubble because of vibes.

I called it because the data was undeniable:

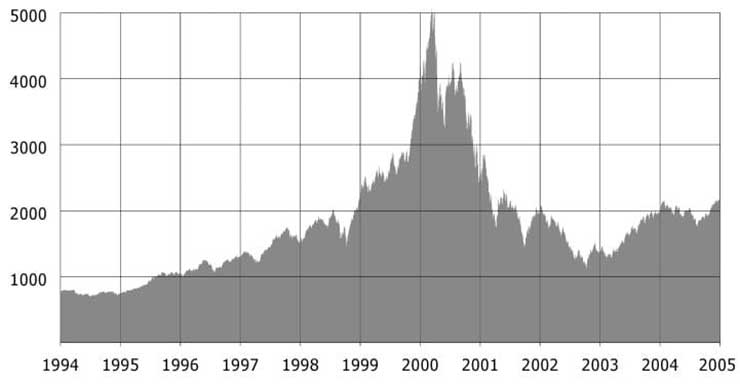

So what happens when insiders warn and the market ignores them?

The same thing that happens before every correction:

- Executives speak plainly.

- Analysts rationalize.

- Investors keep bidding.

- The pressure builds quietly.

And then, suddenly, it doesn’t.

The insiders have already spoken:

OpenAI. NVIDIA. Google. Microsoft.

And yes — Gartner. And me.

The only voice missing that was missing Wall Street’s – until Friday.

Actually, that’s not true. There is another voice missing: The Motley Fool is asleep at the switch: Why there’s no press on mispricing