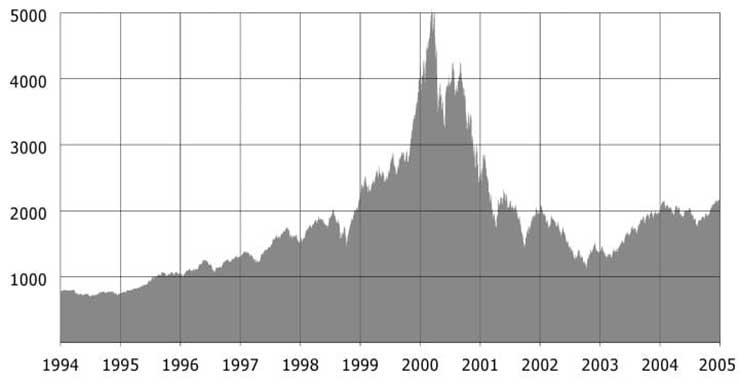

The coming AI reckoning: Why Wall St. is mispricing the largest unreported risk since the dot-com bubble

What is the revenue model for AI?

- It is not social media.

- It is not “we will build it and they will come.”

- It is not Facebook, Instagram, or YouTube, where one influencer reaches millions and advertising makes money.

AI is a 1:1, intimate, high-touch service, not a 1-to-millions broadcast system.

- Advertising doesn’t scale, but adverising requires scale.

- Subscriptions plateau.

- “Flat-rate AI” is a fantasy: capex, inference cost, GPU cycles, liability, and regulatory exposure make that model impossible.

- Token-based billing will not work, because tokens are a lousy proxy for compute. If you want to bill for compute, you need to measure compute as described at the bottom of this story.

In other words:

You are investing billions in something you cannot monetize — and trust will collapse long before scale arrives.

Why? Because:

No memory → no trust

No trust → no adoption

No adoption → no scale

No scale → no revenue

Nobody was afraid of Facebook when they signed up. Nobody feared Twitter, LinkedIn or YouTube.

You cannot say that about AI.

Gary Vaynerchuk has 4.3M followers.

The fear is justified — because the architecture is broken

- hallucinations

- mirages

- fabricated citations

- false medical advice

- five wrongful death suits

- deepfakes

- not enough electricity to power the growing number of CPU cycles

- compliance virtually impossible under potentially conflicting requirements of FTC/HIPAA/COPPA/FERPA/KOSA, etc.

- 14,000 Amazon employees cut and replaced with AI

- 15,000 Microsoft employees cut and replaced with AI

- rising fear of the Luddite cycle repeating

This is not hype.

This is structural.

LLMs today do not forget safely, do not remember reliably, and do not improve based on governed, verified user input.

They use RAG (Retrieval-augmented generation) to compress, discard and hallucinate to survive finite memory limits. These limits are a given. They cannot be iterated away.

LLMs survive their finite memory limits the same way JPEGs overcame the limits of slow networks: through lossy compression. JPEG throws away pixels. LLMs throw away facts. And the loss isn’t obvious at first glance.

But look closely at a JPEG and you begin to see the gaps: the blurred edges, the missing detail, the artifacts that weren’t visible at first. Look closely at an LLM’s responses and the same pattern appears. The seams show. The missing facts show. And once you see those gaps, you understand what the system has really lost.

What JPEGs lose are pixels.

What LLMs lose is truth.

Without reliable memory, AI cannot be trusted. Without trust, AI cannot scale. And without scale, the market caps tied to AI infrastructure evaporate.

The exposures are staggering over the next 3-5 years:

- 25–50% of Microsoft’s $4T valuation tied to AI

- 20–45% of Alphabet’s $3T valuation tied to AI

- 15–30% of Apple’s $3T valuation tied to AI

And those are just three companies that see AI as their future. Consider Amazon. Consider Meta. Consider Salesforce, etc.

These valuations assume:

- adoption

- compliance

- safety

- revenue

- insurance

- regulatory approval

None are guaranteed. Most are not possible without a governed, loss-less architecture.

This is the largest unpriced risk in modern tech.

The 3-step case Wall St. hasn’t heard yet. But will.

1. No metering → no pricing power

If you cannot meter access, volume, or quality at the boundary, every AI feature collapses into:

“all-you-can-eat” → ARPU → zero

Fraud, scraping, automated misuse, and unbounded consumption destroy margins.

Metering is not optional.

Metering is the product.

2. No receipts → no scale

Without tamper-proof, regulator-ready logs:

- general counsel cannot face regulators

- insurers cannot underwrite

- enterprises cannot deploy

- plaintiffs’ lawyers can run wild

Every blocked action, every override, every escalation must generate a cryptographically signed receipt.

No receipts = no enterprise contracts.

3. No compliance → no regulated customers

FTC, HIPAA, COPPA, FERPA, KOSA, GLBA, EU AI Act.

All potentially conflicting.

All mandatory.

All impossible under today’s architecture.

Without governed memory, governed forgetfulness, governed learning, and governed last-gate checks, no enterprise or public-sector adoption is safe.

If AI cannot comply, revenue cannot materialize.

What management must demonstrate to prove a real revenue model

Boards and investors should ask CEOs of LLM companies:

“How do you meter? How do you turn meters into SKUs? And how do you produce tamper-proof receipts after an incident?”

The answer must include:

- boundary metering (access, volume, quality)

- a kill switch with receipts

- a compute-free mechanism for reconciling conflicting regulations

- SKU logic tied to safety gates and audit lanes

- a memory layer that never loses data and never fabricates

Right now, none of the major LLM vendors can answer this question honestly.

What exists today is an expense, not a product

Executives keep saying:

“We’ll monetize later.”

Later than what?

- regulatory tolerance

- insurer patience

- shareholder runway

- public trust

- scrutiny in the House and the Senate

AI without meters, receipts, and regulatory lanes is not a product. It is an unbounded liability line.

I’ve already engineered and filed a working revenue model with USPTO

Boundary-metered, governed AI, with…

- receipts

- value-based compute allocation

- governed learning loops

- tamper-proof audit packets = a viable, regulator-safe revenue engine

This is not a deck.

This is not theory.

This is filed with USPTO.

A white-paper-grade background exists.

It is called AI$. It is self-evident. It is inevitable.

If enterprises need mechanics-level disclosure, counsel-only review can be arranged.

The unspoken truth: The market is pricing AI like electricity, but it is much closer to GMOs

Just a little bad press made genetically modified foods toxic. AI is on the same trajectory.

The lawsuits are here.

The hearings are here and here.

The regulatory orders are coming.

The fractures in the architecture are already here.

This is the AI reckoning.

And Wall Street is not ready.