Cramer, WSJ wrong on AI bubble timing, but right on mispricing from runaway capex, no revenue model

The Wall Street Journal called the bubble on December 12. Jim Cramer followed two days later.

Why?

Because AI capex is exploding without commensurate revenue — and without a viable revenue model to support it.

For example, Oracle dropped more than 11% on Thursday, December 11 after reporting results and issuing guidance tied to AI spending.

But on Thursday, December 18, lower-than-expected inflation for the 12 months ending in November buoyed the entire market.

The tech-heavy NASDAQ jumped 1.5%.

By Friday, December 19, AI stocks were rising again.

So what changed?

Nothing.

- AI still suffers from flat adoption.

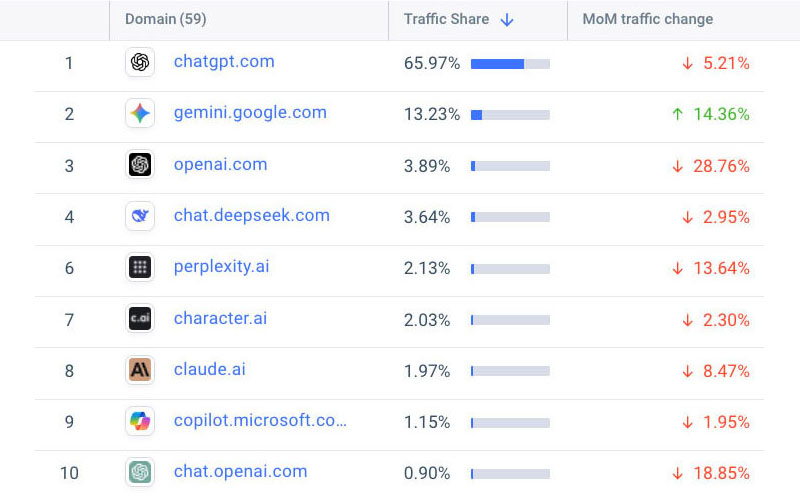

- Usage is not growing across major LLM platforms. See charts, below.

- Capex remains unbounded.

- There is still no durable revenue model to pay for it.

- There is still no meaningful effort to restore trust, or to give users a seat at the table of governance.

GOOG, MSFT, AAPL, AMZN, META and Anthropic are a hot mess.

The fundamentals haven’t improved.

Only the narrative did.

The market chose optimism over facts.

And that distinction matters more than the price action of a single week.

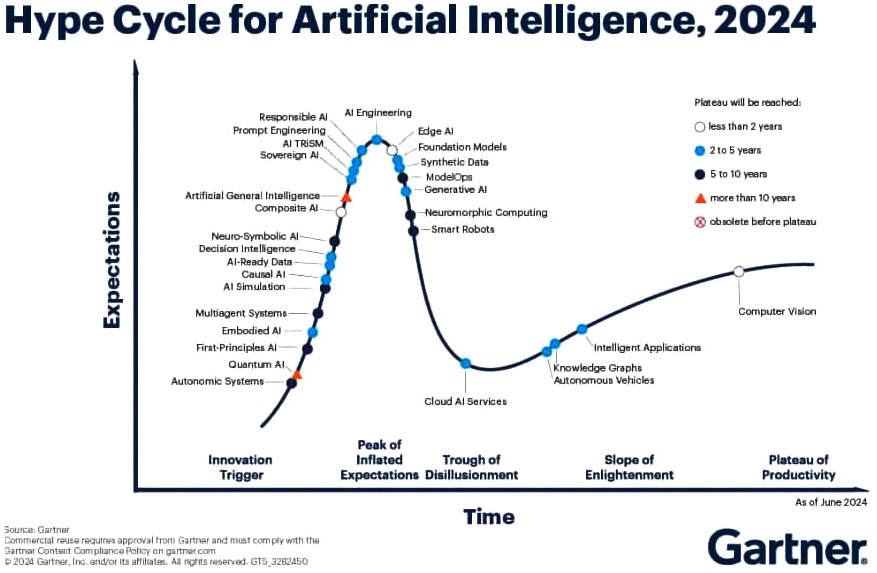

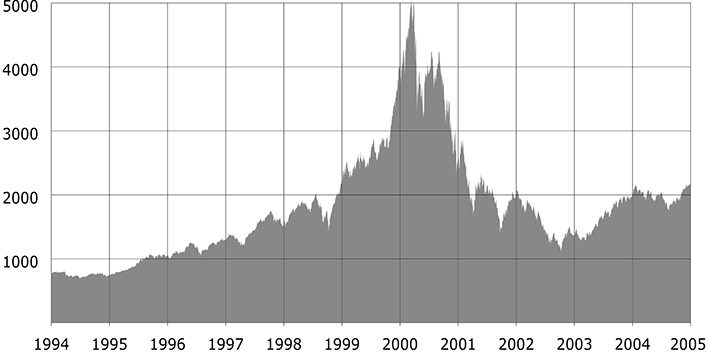

Three charts from independent sources all show that adoption is flat. Two charts show what bubble looks like, after the fact.