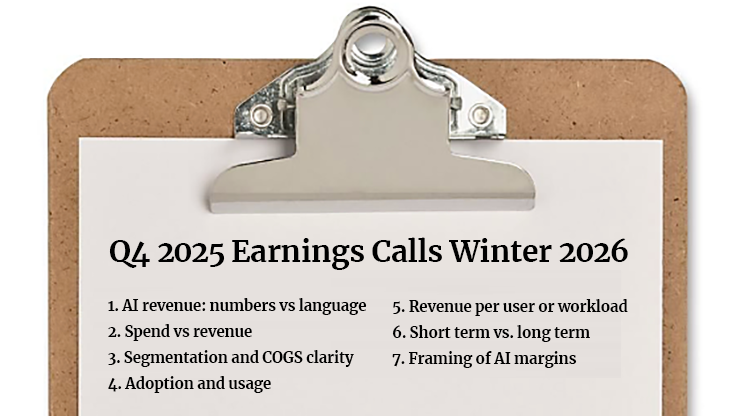

| What to listen for |

What this means |

| 1. AI revenue |

|

|

Are AI revenues discussed in concrete dollar terms, or described using words like

“strong,” “early,” “encouraging,” or “meaningful”?

|

When revenue is material, it is quantified.

Continued reliance on adjectives suggests AI revenue is still immaterial or uneven.

|

| 2. Cost recovery |

|

|

Advances in efficiency and scale will offset rising compute expense. Token-based or flat-rate pricing will recover cost.

|

No mechanism exists for compute efficiency to improve with scale. Compute increases with larger context windows, multimodality, agents and safety layers. Tokens are an inaccurate usage proxy, not a compute meter, and flat-rate pricing severs price from cost entirely. So, as adoption grows, inference costs scale up, not down.

|

| 3. Spend vs revenue |

|

|

Discussion of increased spending on compute, data centers or infrastructure

without a clear link to revenue.

|

Costs are scaling faster than returns.

Even with growth, margins may compress if spend outpaces monetization.

|

| 4. Segmentation |

|

|

Whether AI is reported as a standalone segment, including any discussion of

AI-related COGS, or blended into cloud, services or platform results.

|

Blended reporting and absent COGS disclosure indicate AI economics are not yet

independently stable or ready for direct margin scrutiny.

|

| 5. Adoption and usage |

|

|

Whether management provides adoption and/or usage trends or avoids adoption and usage metrics entirely.

|

If only year-over-year data is offered, this may obscure the reported stall which began in Spring 2025. If short-term adoption trends and/or usage are not discussed, they may no longer be accelerating.

|

| 6. Revenue per user or workload |

|

|

Discussion — or absence — of revenue per user, per seat, per query or per workload.

|

Without revenue density metrics, it is difficult to assess whether growth scales

profitably or dilutes margins.

|

| 7. Short term vs. long term |

|

|

Guidance framed primarily in the long term, such as “early innings” or

“multi-year opportunity,” rather than near-term contribution.

|

Management is signaling limited short-term visibility into AI margins, usage, adoption or cash-flow impact.

|

| 8. Framing of AI margins |

|

|

Direct questions about AI margins that are answered indirectly,

deferred, or reframed.

|

Margin structure is still evolving, internally sensitive,

or not yet favorable enough to discuss explicitly.

|