Buy Google. Sell Apple.

Google is feeding the future. Apple is harvesting the past. Warren Buffett is no dummy.

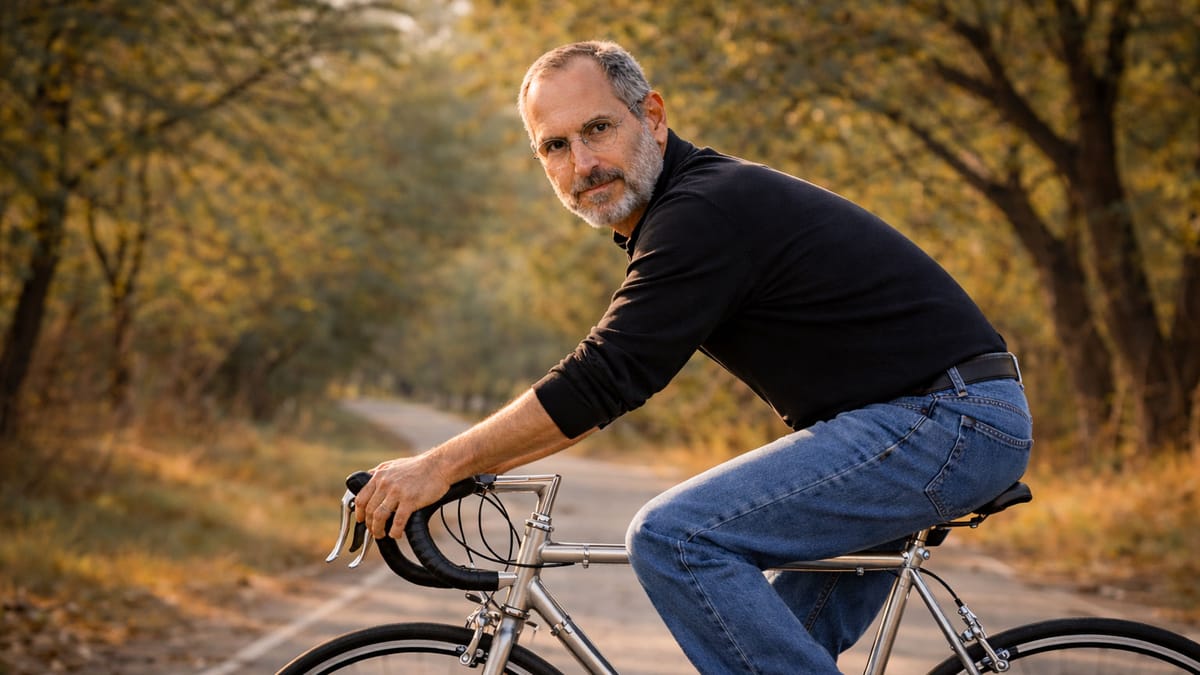

In 1984, Apple sold a simple idea: the computer as a “bicycle for the mind.”

Steve Jobs meant something very specific by that.

Humans are not especially efficient at moving — until they get on a bicycle.

On a bike, a human becomes one of the most energy-efficient travelers on Earth.

The machine doesn’t replace the human.

It multiplies human capability.

Jobs believed computers should do the same for thinking.

Not automate it.

Not replace it.

Amplify it.

That was the promise: leverage for the mind.

What the AI industry is doing instead

- Chasing benchmarks

- Shipping demos

- Optimizing for applause

That’s theater.

None of it produces higher cognition.

Two things the AI industry seems blind to

1. AI as a collaborator

- remembers context

- reasons across time

- maintains continuity

- pushes back when you’re wrong

This does not require:

- bigger models

- faster inference

- new architectures

It requires:

- memory

- governance

- persistence

Layers between the model and the user, not a different model.

2. Genius-level cognition

This is separate — and rarer.

Genius-level cognition means:

- pattern compression across domains

- insight that compounds over time

- non-obvious connections

- judgment, not just recall

This is not collaboration.

It’s amplification.

And crucially:

- it is already within reach

- it is patent-pending

- it is a short iteration away

- it does not require changing the underlying models

The industry is missing this entirely.

Apple is choosing safety over depth

- AI-lite features

- forgetful by design

- no persistence

- no continuity

- no collaboration

Email rewriting is fine.

Summaries are fine.

But this bolts the door on the very thing the bicycle metaphor promised:

- leverage

- continuity

- compounding insight

AI becomes:

- a feature

- a cost of doing business

- pure COGS (cost of goods sold)

Margins protected.

Future risked.

The hardware math is turning hostile

Apple still expects people to pay:

- $1,000+ for an iPhone 17

- for marginal improvements

- as hardware differentiation collapses

Meanwhile:

- a $50 Samsung Galaxy exists

- with a better screen

- a better camera

- and performance that is “good enough” for most users

People don’t pay 20× for specs.

They pay 20× for leverage.

If the software no longer multiplies human capability,

the pricing model breaks.

Not overnight.

But inevitably.

Google’s structural advantage

- software first

- touches more people daily than any company on Earth

- built to monetize usage, not devices

- it knows how to monetize advertising better anyone, while Apple has no experience at all

Google doesn’t need AI to be impressive.

They need it to be used.

They already know how to turn adoption into oxygen.

This is the real platform shift

Not:

- chatbots

- assistants

- task rabbits

But:

- AI that remembers

- AI that reasons over time

- AI that collaborates

- AI that amplifies cognition

That’s the next bicycle.

Apple is harvesting a tradition it no longer feeds

It’s profitable.

It’s comfortable.

It’s vulnerable.

Tech doesn’t reward comfort for long.

Buy Google.

Sell Apple.

The future belongs to the company that builds multipliers —

not the one protecting margins.