Web + App data show AI adoption rate flat Aug-Nov

The mainstream narrative says AI adoption is exploding. But two independent datasets—Similarweb for web traffic and Appfigures for mobile app downloads—show a different pattern. Across four months of data, from early August through late November, both web usage and mobile installs have flattened. There is no accelerating curve.

Update Dec. 12: New data shows the demand curve didn’t flatten in August. It flattened in spring 2025, several months earlier, yet publicly traded companies with massive, material AI exposure never disclosed the stall across three consecutive quarters of SEC filings.

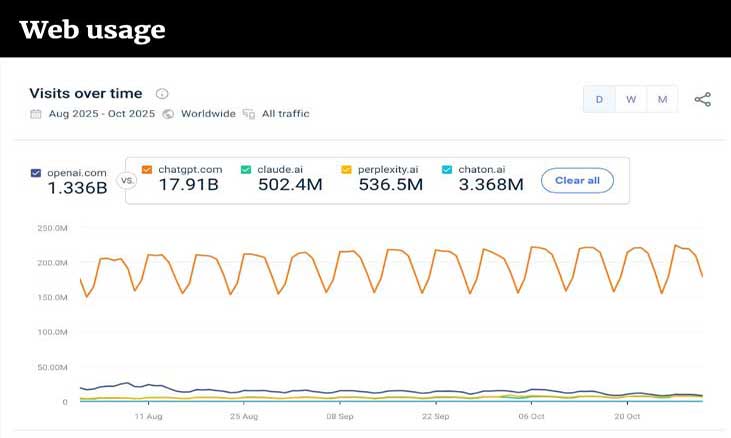

Web usage: Flat from August through November

ChatGPT.com is the primary access point for OpenAI’s consumer AI product. According to Similarweb, traffic grew from 204.7 million visits on Monday, August 4, 2025 to 224.5 million on Monday, October 27, 2025. That is a 9.7 percent increase over nearly three months—roughly 40 percent annualized. For a product promoted for exponential growth, this is essentially a flatline.

This information does not come from OpenAI, which does not publish usage numbers. It comes from Similarweb, an independent analytics firm that tracks global traffic across millions of sites.

Anyone can verify the numbers by visiting Similarweb.com, signing up for a 7-day free trial and searching for chatgpt.com – or by reading my expanded analysis – which explains why the absence of indelible memory is one of the core obstacles to AI adoption and scale:

The coming AI reckoning: Why Wall St. is mispricing the largest unreported risk since the dot-com bubbleThe usage pattern is consistent and revealing. Traffic dips every weekend, then returns to a weekday peak. This weekly cycle has been stable for months. It shows that ChatGPT is used primarily during the workweek—largely on desktops and laptops—not as part of daily, always-on consumer behavior.

New Similarweb data through November 28 confirms the same trend. The November chart shows traffic oscillating between roughly 150 million and 220 million daily visits, repeating the same weekday peaks and weekend troughs seen earlier in the fall. The only notable deviation is a sharp drop during the Thanksgiving holiday week, when workplace usage fell. After Thanksgiving, traffic returned to the same established range. This reinforces the larger point: ChatGPT behaves like a workplace tool, not a universal, consumer-integrated technology.

ChatGPT remains the dominant product in the space—more than thirty times the size of Claude and substantially larger than Perplexity. Yet its growth curve has stalled. All of this was can be seen in Gartner’s Hype Cycle Chart.

Every major Hype Cycle chart shows the same pattern: a rapid surge, a dramatic drop, and a slow climb that never returns to the peak: We have reached Peak AI

Mobile app downloads: Also flat across iPhone/iOS and Android

The same pattern appears in mobile adoption. Appfigures data—covering both iPhone/iOS and Android—shows that daily downloads of the ChatGPT mobile app have been flat since early August.

Across both platforms combined, estimated daily downloads consistently range from roughly 1.0 to 1.3 million per day between August 1 and November 30. There is no upward trend. A brief spike in mid-November was short-lived, and downloads quickly returned to the same baseline level. When new installs remain flat for four straight months, it indicates that the pipeline of new users is not expanding.

Perplexity’s data shows a rise from August through October, peaking at about 400,000 daily downloads across iOS and Android. But by November, downloads had fallen more than 70 percent. This is a textbook hype-cycle curve: curiosity, spike, and decline. Claude’s downloads are minimal on both platforms, registering near zero throughout the same period.

These app-download metrics matter because they capture new user acquisition. If downloads do not grow, the user base does not grow. The four-month plateau across mobile platforms indicates that AI is not expanding as quickly as widely assumed.

Two independent data sources, one pattern

Web traffic (Similarweb) and mobile downloads (Appfigures) measure different aspects of consumer behavior:

• Web usage shows how often people return

• App downloads show how many new people join

Yet both datasets show the same shape over the same four-month window: a plateau.

- ChatGPT’s web traffic is flat.

- ChatGPT’s combined iOS and Android downloads are flat.

- Perplexity’s spike has reversed.

- Claude has no meaningful consumer traction.

When two independent measurement systems—one tracking desktop and mobile web behavior, the other tracking mobile app installs—converge on the same pattern, the pattern becomes difficult to ignore.

What This Means

These data challenge a core assumption embedded in today’s AI narrative: that adoption is on a rocket-trajectory, rising exponentially month after month. That growth is inevitable. That consumer use is expanding without limits.

The combined evidence tells a different story.

AI adoption is not accelerating.

It has already leveled off.

This does not reflect a lack of interest in the technology. It reflects something simpler and easier to measure: actual day-to-day behavior. Across both web and mobile environments, and across both major mobile platforms, usage has settled into a stable range without upward momentum.

The charts tell the story.