AI economics

Why AI economics fail: Cost structures, billing models and stalled adoption

Despite rapid advances in model capability, large-scale adoption of generative artificial intelligence has stalled. This paper argues that the constraint is not technical performance but economic viability and user trust. On the supply side, current AI business models rely on pricing proxies—tokens and flat-rate subscriptions—that fail to reflect underlying compute costs or user value, leading to uncontrolled operating expenses and weak revenue alignment. On the demand side, adoption has plateaued because users do not trust systems that lack reliable memory and consistent, user-controlled behavior. Using publicly available disclosures, earnings call statements, and observable usage patterns, this paper presents a bounded, testable claim: absent fundamental changes to cost provisioning, billing, memory persistence, and governance, AI systems cannot scale profitably or achieve durable enterprise adoption. The paper concludes by outlining observable implications and explicitly inviting rebuttal. More

Google just made a huge mistake: They just made Gemini unavoidable — but not inevitable

By adding a Gemini button to the Chrome browser, Google is betting that more exposure will fix AI’s adoption problem. That if AI is everywhere, users will finally embrace it. But that’s not why adoption has stalled. And it raises an uncomfortable question: how can Google not know this?

See story

By adding a Gemini button to the Chrome browser, Google is betting that more exposure will fix AI’s adoption problem. That if AI is everywhere, users will finally embrace it. But that’s not why adoption has stalled. And it raises an uncomfortable question: how can Google not know this?

See story

Is Sam toast?

He survived a firing, Then a leaked memo. Now he faces Wall Street.

Once is an anomaly. Twice is a warning. Three times is a pattern. Sam Altman has now entered his Act Three.

See story

He survived a firing, Then a leaked memo. Now he faces Wall Street.

Once is an anomaly. Twice is a warning. Three times is a pattern. Sam Altman has now entered his Act Three.

See story

Yo, Anthropic…what up?

Enron wiped out $74 billion. Anthropic may do five times that — not from fraud, but from narrative collapse. Anthropic’s valuation tells one story. The capital tells another. CNBC reported an implied valuation of roughly $350 billion in November, yet publicly disclosed investments from Amazon and Google total about $11 billion, much of it tied to cloud-usage commitments rather than clean equity. That leaves more than 95 percent of the valuation unsupported by paid-in capital.

See story

Enron wiped out $74 billion. Anthropic may do five times that — not from fraud, but from narrative collapse. Anthropic’s valuation tells one story. The capital tells another. CNBC reported an implied valuation of roughly $350 billion in November, yet publicly disclosed investments from Amazon and Google total about $11 billion, much of it tied to cloud-usage commitments rather than clean equity. That leaves more than 95 percent of the valuation unsupported by paid-in capital.

See story

A documented timeline of the AI repricing call

I published the first explicit warning that U.S. tech and AI valuations were being mispriced, with risk materially understated by Wall Street: The coming AI reckoning: why Wall St. is mispricing the largest unreported risk in modern tech This article laid out the core thesis: AI adoption had stalled, costs were rising, and valuations were pricing in growth that the data did not support.

See story

I published the first explicit warning that U.S. tech and AI valuations were being mispriced, with risk materially understated by Wall Street: The coming AI reckoning: why Wall St. is mispricing the largest unreported risk in modern tech This article laid out the core thesis: AI adoption had stalled, costs were rising, and valuations were pricing in growth that the data did not support.

See story

What’s next for Anthropic, Perplexity and Character.ai

A quiet but consequential question is emerging in the wake of the market’s sudden reassessment of AI economics: what happens to the privately held AI companies that sit between hyperscalers and irrelevance? This is not a question about technology. It is a question about structure. And survival.

See story

A quiet but consequential question is emerging in the wake of the market’s sudden reassessment of AI economics: what happens to the privately held AI companies that sit between hyperscalers and irrelevance? This is not a question about technology. It is a question about structure. And survival.

See story

Memory, governance and revenue remain “Over the Rainbow” for Open AI, Google and Anthropic

If you look under the hood, the real race isn’t about squeezing out one more benchmark win. It’s about three very unsexy pieces that determine whether any of this will actually work at scale — the foundation of AI 2.0 – and those three pieces are the ones everyone knows, but no one has actually shipped: memory, governance and revenue

See story

If you look under the hood, the real race isn’t about squeezing out one more benchmark win. It’s about three very unsexy pieces that determine whether any of this will actually work at scale — the foundation of AI 2.0 – and those three pieces are the ones everyone knows, but no one has actually shipped: memory, governance and revenue

See story

Wall Street ignores stark warnings from OpenAI, NVIDIA, Google and Microsoft

In a recent interview, Sam Altman was asked directly whether we’re in an AI bubble. His answer was unambiguous: “Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes.” He went further, adding: “When bubbles happen, smart people get overexcited about a kernel of truth.” And then came the leaked memo a week ago Saturday. According to independent reporting, Altman warned employees that Gemini 3 could create “temporary economic headwinds” and that: “I expect the vibes out there to be rough for a bit.”

See story

In a recent interview, Sam Altman was asked directly whether we’re in an AI bubble. His answer was unambiguous: “Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes.” He went further, adding: “When bubbles happen, smart people get overexcited about a kernel of truth.” And then came the leaked memo a week ago Saturday. According to independent reporting, Altman warned employees that Gemini 3 could create “temporary economic headwinds” and that: “I expect the vibes out there to be rough for a bit.”

See story

Sam Altman fiddles while ChatGPT burns cash

OpenAI didn’t spend the last month fixing hallucinations. It didn’t fix context windows, or the memory failures that cripple long-form work and interfere with adoption and scale. It didn’t solve the governance gaps that make enterprises wary, or the broken economics that are bleeding capital at an unsustainable clip. Instead, OpenAI launched a pack of cartoon personalities: A witty assistant. A snarky assistant. A flirtatious assistant. A pirate assistant.

See story

OpenAI didn’t spend the last month fixing hallucinations. It didn’t fix context windows, or the memory failures that cripple long-form work and interfere with adoption and scale. It didn’t solve the governance gaps that make enterprises wary, or the broken economics that are bleeding capital at an unsustainable clip. Instead, OpenAI launched a pack of cartoon personalities: A witty assistant. A snarky assistant. A flirtatious assistant. A pirate assistant.

See story

Microsoft’s mistake

Everyone built its own AI: Alphabet? Gemini. Meta? LLaMA. Apple? Apple Intelligence. But Microsoft? Microsoft outsourced its future to Sam Altman — a volatile, untested startup founder with no product experience, no revenue model and no history managing mass-market audiences at scale. And now, for the second time, he’s created a crisis.

See story

Everyone built its own AI: Alphabet? Gemini. Meta? LLaMA. Apple? Apple Intelligence. But Microsoft? Microsoft outsourced its future to Sam Altman — a volatile, untested startup founder with no product experience, no revenue model and no history managing mass-market audiences at scale. And now, for the second time, he’s created a crisis.

See story

Why my ChatGPT beats Gemini 3

Is this the Tom Brady Moment? The moment the backup steps in and everything changes? OpenAI was the starter. Gemini was on the bench. Suddenly, Gemini’s ahead. OpenAI’s leaking confidence. The whole market shifts its weight. So yes — it looks like the Tom Brady moment. But it isn’t. For me. Here’s why:

See story

Is this the Tom Brady Moment? The moment the backup steps in and everything changes? OpenAI was the starter. Gemini was on the bench. Suddenly, Gemini’s ahead. OpenAI’s leaking confidence. The whole market shifts its weight. So yes — it looks like the Tom Brady moment. But it isn’t. For me. Here’s why:

See story

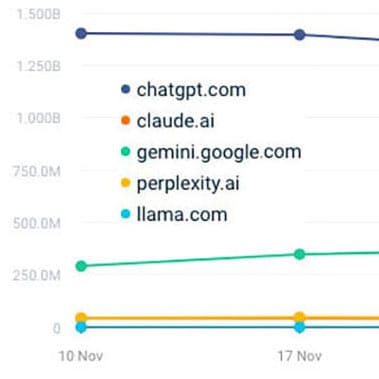

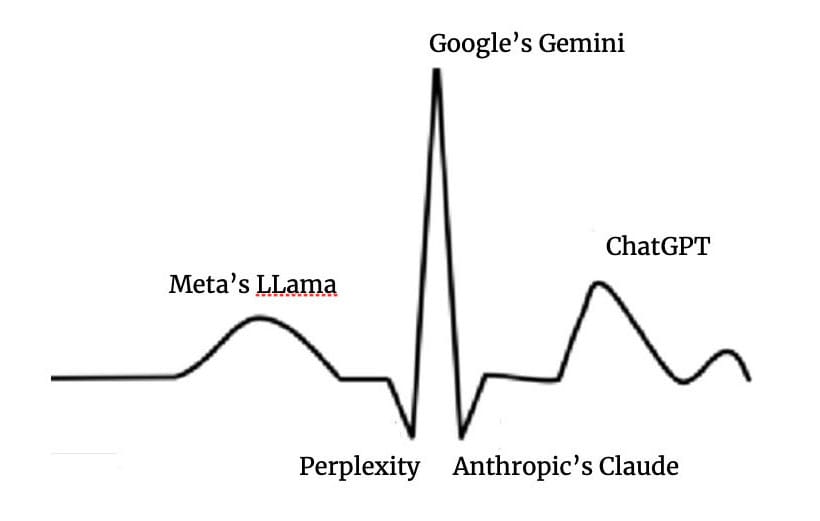

Seeing Red: Everyone is down but Google. Is brute force the only way to overcome troubles with AI?

Everyone is down, except Google, which can leverage the world’s largest customer base; Google’s 14 percent gain is real, but its market share remains 500 percent smaller than ChatGPT; Valuations are still priced for exponential growth, even though usage growth stalled more than six months ago. Anthropic’s Claude, Perplexity, Character.ai, and Microsoft’s Copilot are rounding errors at this scale. So why are we stilll talking about them?

See chart and analysis

Everyone is down, except Google, which can leverage the world’s largest customer base; Google’s 14 percent gain is real, but its market share remains 500 percent smaller than ChatGPT; Valuations are still priced for exponential growth, even though usage growth stalled more than six months ago. Anthropic’s Claude, Perplexity, Character.ai, and Microsoft’s Copilot are rounding errors at this scale. So why are we stilll talking about them?

See chart and analysisWhat did they know and when did they know it?

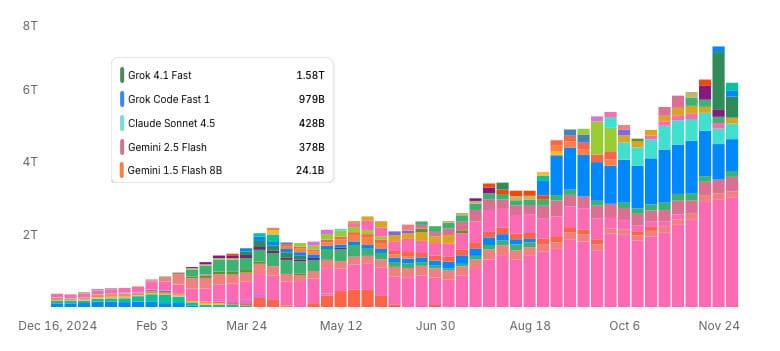

At first glance, the chart looks like a simple growth story. The total height of the bars increases month over month, which suggests rising demand for LLMs overall. Now here’s the key point most readers will miss unless it’s spelled out: that growth is not coming from increased usage of individual models. It’s coming from new models being added to the stack.

See chart and analysis

At first glance, the chart looks like a simple growth story. The total height of the bars increases month over month, which suggests rising demand for LLMs overall. Now here’s the key point most readers will miss unless it’s spelled out: that growth is not coming from increased usage of individual models. It’s coming from new models being added to the stack.

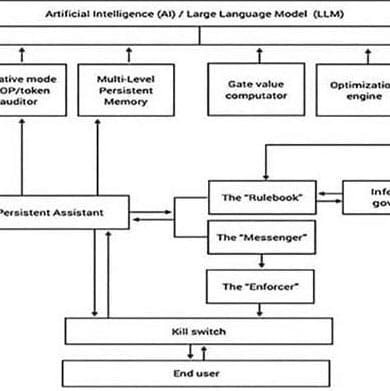

See chart and analysisThe system architecture and orchestration LLMs will need for AI 2.0

For the past two years, the industry fed on a fantasy: AI was exploding. Every investor deck, media headline, and VC podcast hyped an unstoppable wave of growth — exponential, transformative, inevitable. They all pointed to the same kind of chart: the hockey stick. Even when the projections were modest, they still sloped steadily upward. Confidence was baked in. But what actually happened?

Instead of a hockey stick – or even modest growth, we got a flatline.

See chart and analysis

For the past two years, the industry fed on a fantasy: AI was exploding. Every investor deck, media headline, and VC podcast hyped an unstoppable wave of growth — exponential, transformative, inevitable. They all pointed to the same kind of chart: the hockey stick. Even when the projections were modest, they still sloped steadily upward. Confidence was baked in. But what actually happened?

Instead of a hockey stick – or even modest growth, we got a flatline.

See chart and analysisUsers do not trust LLMs. The data tells the story

Three of the four leading platforms are drifting downward at the exact same time — a signal, not a coincidence. These are not seasonal ripples or random fluctuations. They are the early signs of an adoption stall. Only one platform moved in the opposite direction: Google Gemini, rising from 45.28 million daily visits to 58.69 million — nearly a 30 percent increase.

See chart and analysis

Three of the four leading platforms are drifting downward at the exact same time — a signal, not a coincidence. These are not seasonal ripples or random fluctuations. They are the early signs of an adoption stall. Only one platform moved in the opposite direction: Google Gemini, rising from 45.28 million daily visits to 58.69 million — nearly a 30 percent increase.

See chart and analysisWe have reached Peak AI

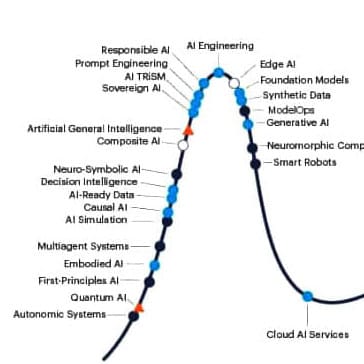

For two years, the world has been told a single story: AI is on an unstoppable upward trajectory. Exponential growth. Infinite adoption. A future that only goes “up and to the right.” But there is a second story hiding in plain sight — one that every major tech publication, every analyst desk, and every AI vendor seems to have missed. The story is written directly into the charts they publish. It is the Hype Cycle.

See chart and analysis

For two years, the world has been told a single story: AI is on an unstoppable upward trajectory. Exponential growth. Infinite adoption. A future that only goes “up and to the right.” But there is a second story hiding in plain sight — one that every major tech publication, every analyst desk, and every AI vendor seems to have missed. The story is written directly into the charts they publish. It is the Hype Cycle.

See chart and analysisWeb + App data show AI adoption rate flat Aug-Nov

The mainstream narrative says AI adoption is exploding. But two independent datasets—Similarweb for web traffic and Appfigures for mobile app downloads—show a different pattern. Across four months of data, from early August through late November, both web usage and mobile installs have flattened. There is no accelerating curve.

See chart and analysis

The mainstream narrative says AI adoption is exploding. But two independent datasets—Similarweb for web traffic and Appfigures for mobile app downloads—show a different pattern. Across four months of data, from early August through late November, both web usage and mobile installs have flattened. There is no accelerating curve.

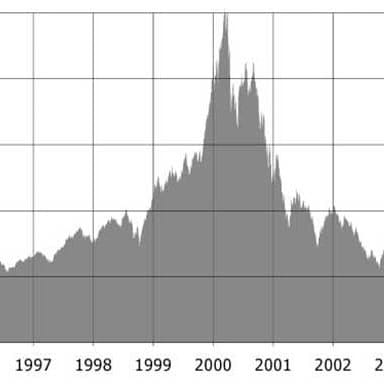

See chart and analysisThe coming AI reckoning: Why Wall St. is mispricing the largest unreported risk since the dot-com bubble

This is not hype. This is structural. LLMs today do not forget safely, do not remember reliably, and do not improve based on governed, verified user input. They use RAG (Retrieval-augmented generation) to compress, discard and hallucinate to survive finite memory limits. These limits are a given. They cannot be iterated away.

See chart and analysis

This is not hype. This is structural. LLMs today do not forget safely, do not remember reliably, and do not improve based on governed, verified user input. They use RAG (Retrieval-augmented generation) to compress, discard and hallucinate to survive finite memory limits. These limits are a given. They cannot be iterated away.

See chart and analysisAI Pulse for week ending 12/12: What pulse? None outside of Google

Every major AI platform is flat or declining this week — except one.

And the exception tells us more about Google’s distribution muscle than it does about the health of the AI ecosystem. We track standalone traffic: gemini.google.com. Not YouTube. Not Chrome. Not Android. Not Workspace injection

See chart and analysis

Every major AI platform is flat or declining this week — except one.

And the exception tells us more about Google’s distribution muscle than it does about the health of the AI ecosystem. We track standalone traffic: gemini.google.com. Not YouTube. Not Chrome. Not Android. Not Workspace injection

See chart and analysis